How to protect a credit card from scammers

No one is safe from illegal data theft, which can lead to the loss of money from your account. And this happens all the time – people are stealing money from their accounts. In some cases, the victims themselves even tell the fraudsters all the data, not understanding what they are doing. Most people think that they are not robbed and begin to worry when the money has already been withdrawn and nothing can be done. There are tons of ways to steal your money. True, this probability can be kept to a minimum if some security measures are used. Perhaps some tips will seem elementary to you, but it is with them that security begins.

Card fraud methods

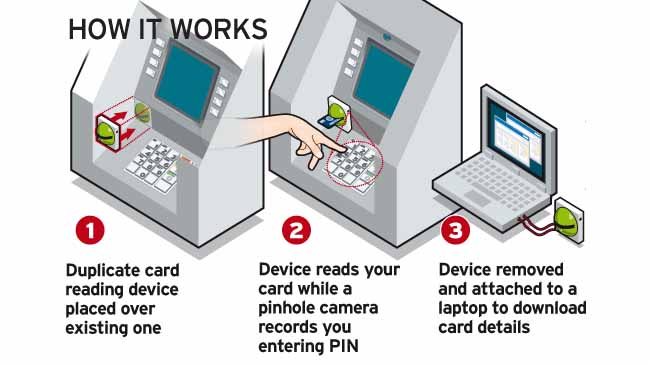

- Skimming is when scammers put various dubious devices on an ATM and physically copy your card details. The skimmer is a small device attached to the card reader, while it looks like part of the design of the ATM. Using this device, fraudsters receive information from a victim’s card in order to make сopy of the card. They will use a fake card, but the money will be debited from the original account.

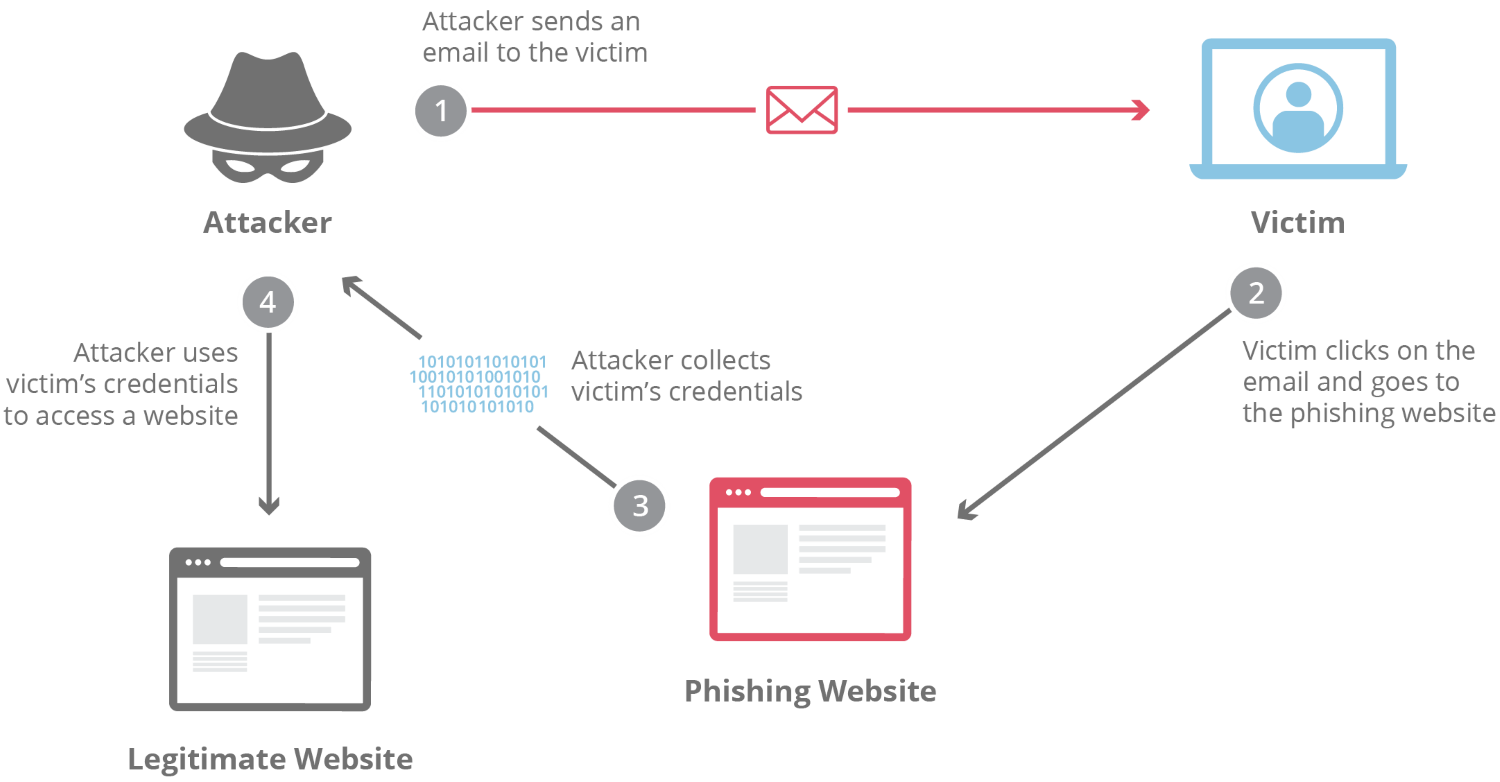

- Phishing is a fraud method whose main purpose is to get data of your credit card: PIN code, card number, CVC number (three digits near the signature), card expiration date, SMS with a code. At the same time, fraudsters do not need to know all of the above, so the main thing to understand is never to disclose this data to anyone. Of course, when you pay, for example, in an online store, you will be asked for a card number, expiration date, and CVC: so buy only on trusted sites. Perhaps someone even received a “letter from the bank” asking them to follow the link and specify the details. Moreover, the phishing page looked like a real one, the same colors, fonts, logos, with the exception of the annoying “typo” in the address bar.

- Recently, a subspecies of phishing is spreading more and more – vishing. Simply put, phone divorce. Fraudsters simulate an autoinformer call. A frightening robotic voice informs you that your card is blocked or has been attacked by hackers, or you urgently need to pay off loan debt. For details call this number. You call, and the courteous “operator” asks you to “verify” the card number, its validity period, verification code, and so on. Once you have dictated the last digit, you can say goodbye to your money. Until you come to their senses, they will already be spent in some online store. In any case, never communicate this data by voice. If you fall for wiring and provide your data, it will be next to impossible to return money after that: because you reported everything yourself and voluntarily.

Some tips on how to distinguish a real bank employee from a fake?

- A fake employee calls and asks for a code from SMS or card data (number, expiration date, CVC code) – real bank employee should never do this.

- The fake employee is not well informed. For example, it cannot answer the question about your other products in the bank or recent transactions.

- A fake employee is too persistent: trying to convince you, insists that you provide the necessary information right now.

- A fake employee calls from a mobile phone, or his number is not determined.

Methods to secure your cards

- Physically protect the card. In most cases, credit cards are stolen along with wallets in which money is already located. It is clear that few people are comfortable wearing a card in a lockable pocket, but this is correct. If you can not do without a purse, then take care that it is in a place inaccessible to others.

- Learn the PIN by heart. If there is no hope for memory, write it on a piece of paper, but store it separately from the card.

- Keep silent. Bank card rules prohibit you from sharing your PIN code with other people. Remember that this password is not allowed to request store sellers and bank employees. If someone or something, other than an ATM and a payment terminal, asks for a PIN code for the card – do not hesitate, this is done by a scammer. Experts advise not to store the document with a password but to destroy it immediately after remembering or encryption.

- Avoid witnesses. When using the card in ATMs, try to avoid accidental onlookers who might snoop on a pin code or distract attention.

- Check the ATM. Often, fraudsters steal card data using fake ATMs or special devices that attach to them. Use only reliable devices installed in stores, business centers or the banks themselves. Be suspicious of ATMs located in the back streets. If there is any doubt about the authenticity of the terminal, then call the bank to which it belongs and specify its address. If you are afraid, avoid contact with the machine.

- Do not carry the card and phone together. Put the card in the phone case – did half the battle for fraudsters. When paying, he will receive a text message with the code on your phone.

- Do not enter the Internet bank from other people’s computers or from public unsecured networks. If this still happened, at the end of the session, click “Exit” and clear the cache.

Install antivirus on your personal computer and update it in a timely manner. Use modern versions of the browser and email programs. - Do not download files obtained from unverified sources, do not click on unreliable links. Do not open suspicious emails and immediately block their sender.

- Without the need do not enter any of your personal data, in addition to the username and password.

- Check the address bar. A secure HTTPS connection must be used. And the slightest discrepancy with the bank’s domain almost certainly means that you are on a phishing site.

- Create a complex password to enter your personal account, and also use one-time passwords requested by banks to confirm actions in your personal account.

- Buy at trusted stores. Data theft often happens with online payments. This happens with the help of viruses or purchases through scam sites (some of them can be very similar to known resources). In this case, we recommend monitoring virus protection with the help of special programs.

- Get a separate card for online shopping. An additional card uses the same account as the main one, but it has different payment details. Even if they are taken away, you will block the additional card and stay with the main one.

- Set a limit on expenses on an additional card, for example, $1000 per month. The limit can be changed at any time.

Online Banking Security Guidelines

Online banking, also known as internet banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution’s website.

Hypertext Transfer Protocol Secure (HTTPS) is an extension of the Hypertext Transfer Protocol (HTTP). It is used for secure communication over a computer network, and is widely used on the Internet.

Using all these recommendations, you will significantly protect your card from financial losses. Have a good shopping!